do i have to pay estimated taxes for 2020

Certain taxpayers must make estimated tax payments throughout the year. Citizens or resident aliens for the entire tax year for which theyre inquiring.

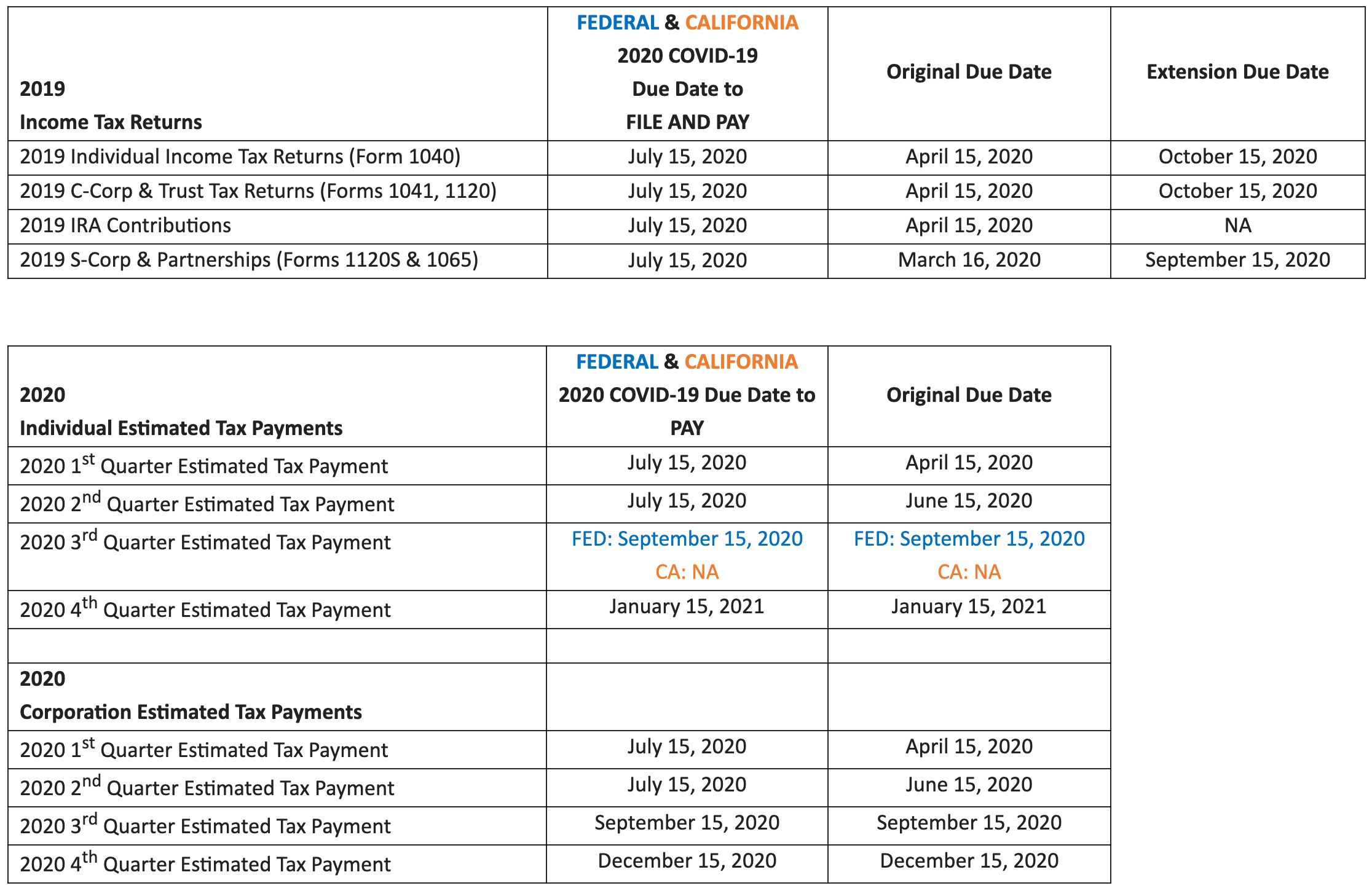

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

In most cases you must pay estimated tax for 2020 if both of the following apply.

. You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Income in America is taxed by the federal government most state governments and many local governments. Taxpayers generally must make estimated tax payments if they expect to owe 1000 or more when they file their 2020 tax return.

Aside from business owners and self. Taxpayers must make a declaration of estimated income tax and pay estimated tax payments if their estimated Louisiana income tax after credits and taxes withheld is. The federal income tax system is progressive so the rate of.

Estimated tax is the method used to pay tax on income when no taxor not enough taxis withheld. If youre required to make estimated tax payments and your prior year California adjusted gross income is more than. You ll owe at least 1000 in federal income taxes this year even after.

If so then youre not required to make estimated tax payments. Do I have to pay estimated taxes for 2020. 75000 if marriedRDP filing separately.

If you estimate that you will owe more than 500 in tax for 2022 after subtracting your estimated withholding and credits then you should make quarterly estimated payments. You may be required to make estimated tax payments to New York. Likewise pursuant to Notice 2020-23 the due date for your second estimated tax payment was automatically postponed from June 15 2020 to July 15 2020.

Then you must base. If your federal income tax withholding plus any timely estimated taxes you paid amounts to at least 90 percent of the total tax that you will owe for this tax year or at least 100. Taxpayers who estimate they will owe 200 or more in tax on income not subject to withholding must pay estimated tax.

The IRS says you need to pay estimated quarterly taxes if you expect. When the annual income tax return is filed the prepaid estimated tax. The IRS says you need to pay estimated quarterly taxes if you expect.

The tool is designed for taxpayers who were US. Do I have to pay estimated taxes for 2020. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan.

You expect to owe at least 1000 in tax for 2020 after subtracting your withholding and refundable credits. If youre a calendar year taxpayer and you file your 2022 Form. You ll owe at least 1000 in federal income taxes this year even after.

中文 繁體 FS-2019-6 April 2019. Tax system operates on a pay-as-you-go basis. Taxpayers must generally pay at least 90 percent of their taxes throughout the year through.

If your adjusted gross income for the year is over 150000 then its. Basics of estimated taxes for individuals. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe.

This means that taxpayers need to pay most of. An estimate of your 2022 income. WASHINGTON The Internal Revenue Service today reminded the self-employed investors retirees and others with income not subject to withholding that third quarter.

If you answered no to all of these questions you must make estimated tax payments using Form 1040-ES.

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

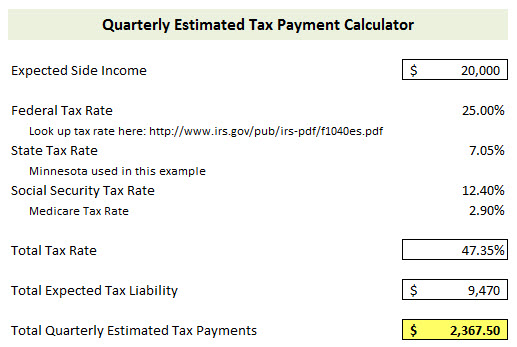

Starting A Side Gig In 2022 Your New Tax Obligations Seibel Katz Cpas

New York Issues Notice Regarding June Estimated Tax Payments

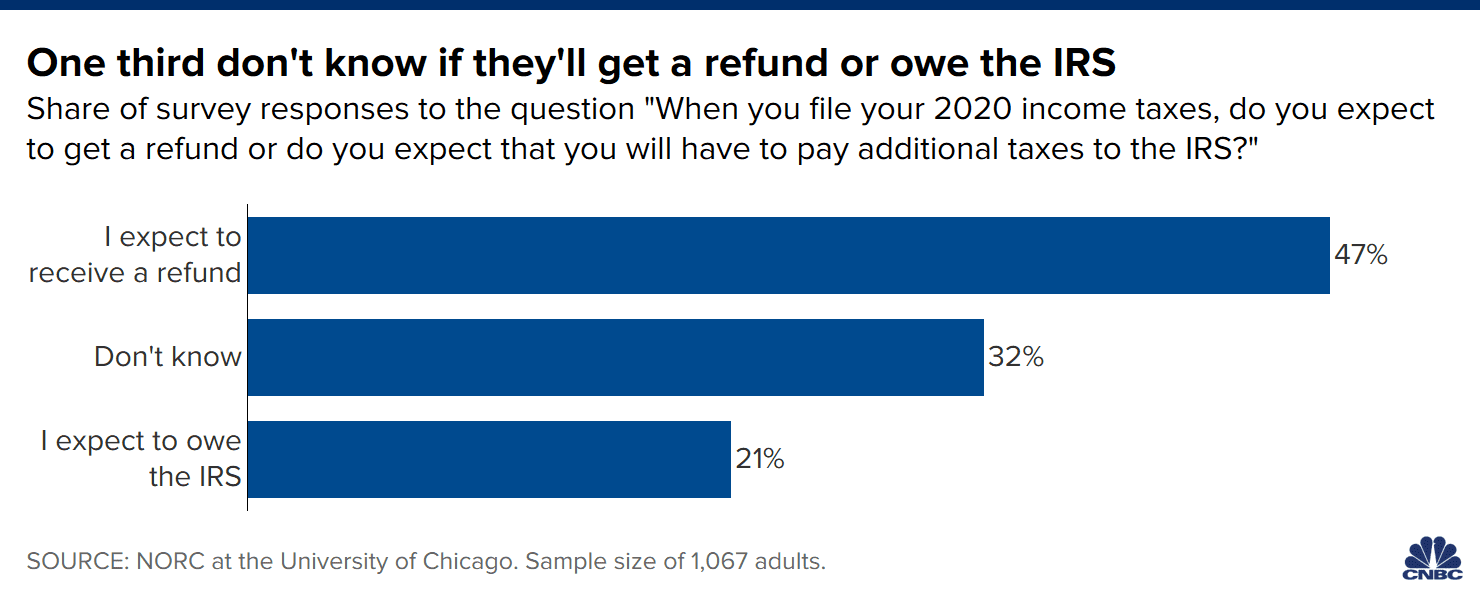

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Tax Season What To Expect Now That Tax Day Is July 15th Thomas Doll

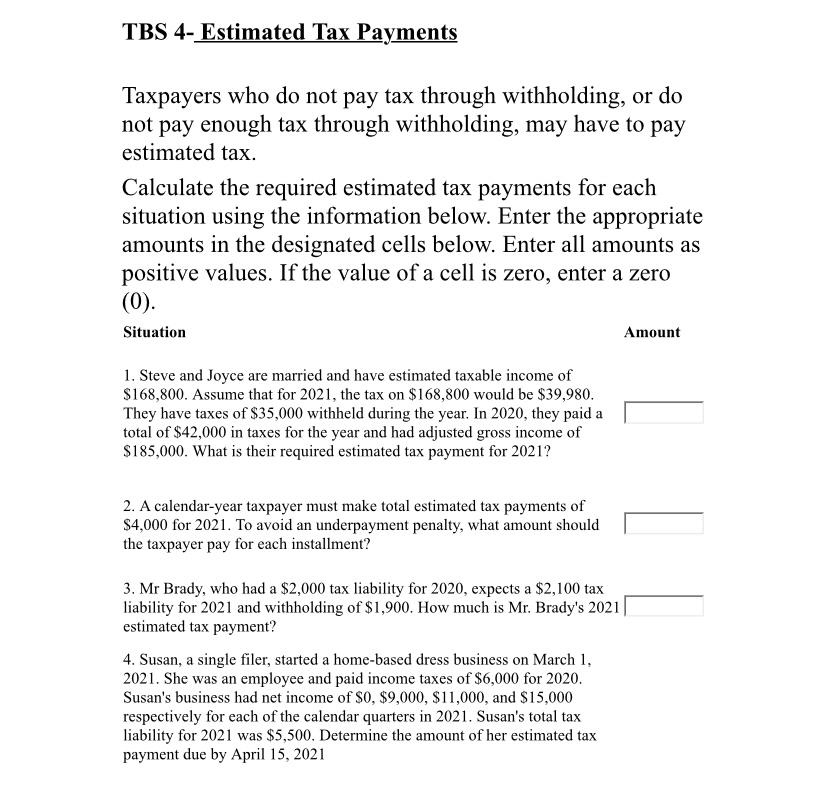

Solved Tbs 4 Estimated Tax Payments Taxpayers Who Do Not Chegg Com

Quarterly Estimated Taxes What Amazon Sellers Need To Know

Quarterly Taxes Due June 15 For Owner Operators Overdrive

How To Calculate And Pay Quarterly Estimated Taxes Young Adult Money

Estimated Taxes Green Trader Tax

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021

How To Making Mn Estimated Tax Payments Online Accounting Cpa Firm Minneapolis Tax Preparation Services St Paul Mn

Irs Reminds Taxpayers To Make Final Estimated Tax Payment For 2020 Scotch Plains Fanwood Nj News Tapinto

What Are Estimated Quarterly Taxes

Should I Pay Estimated Taxes Quest Accounting Solutions

When Are 2020 Estimated Tax Payments Due

Do You Need To Pay Estimated Taxes Dimercurio Advisors

What If You Haven T Paid Quarterly Taxes Mybanktracker

Irs If You Owe 2019 Income Taxes And Estimated Tax For 2020 You Must Make Two Separate Payments On Or By July 15 2020 One For Your 2019 Income Tax Liability